How Economic Relief 2024 Programs Are Impacting Small Businesses-As 2024 begins, small businesses continue to face significant challenges stemming from economic uncertainties, including inflation, supply chain disruptions, and changing consumer behavior. In response, governments worldwide have introduced a variety of Economic Relief 2024 programs designed to help small businesses not only survive but thrive in this new economic climate. These programs are tailored to provide immediate financial support, incentivize innovation, and create long-term growth opportunities. Here’s a closer look at how the Economic Relief 2024 programs are impacting small businesses around the world.

Immediate Financial Assistance: A Lifeline for Small Businesses

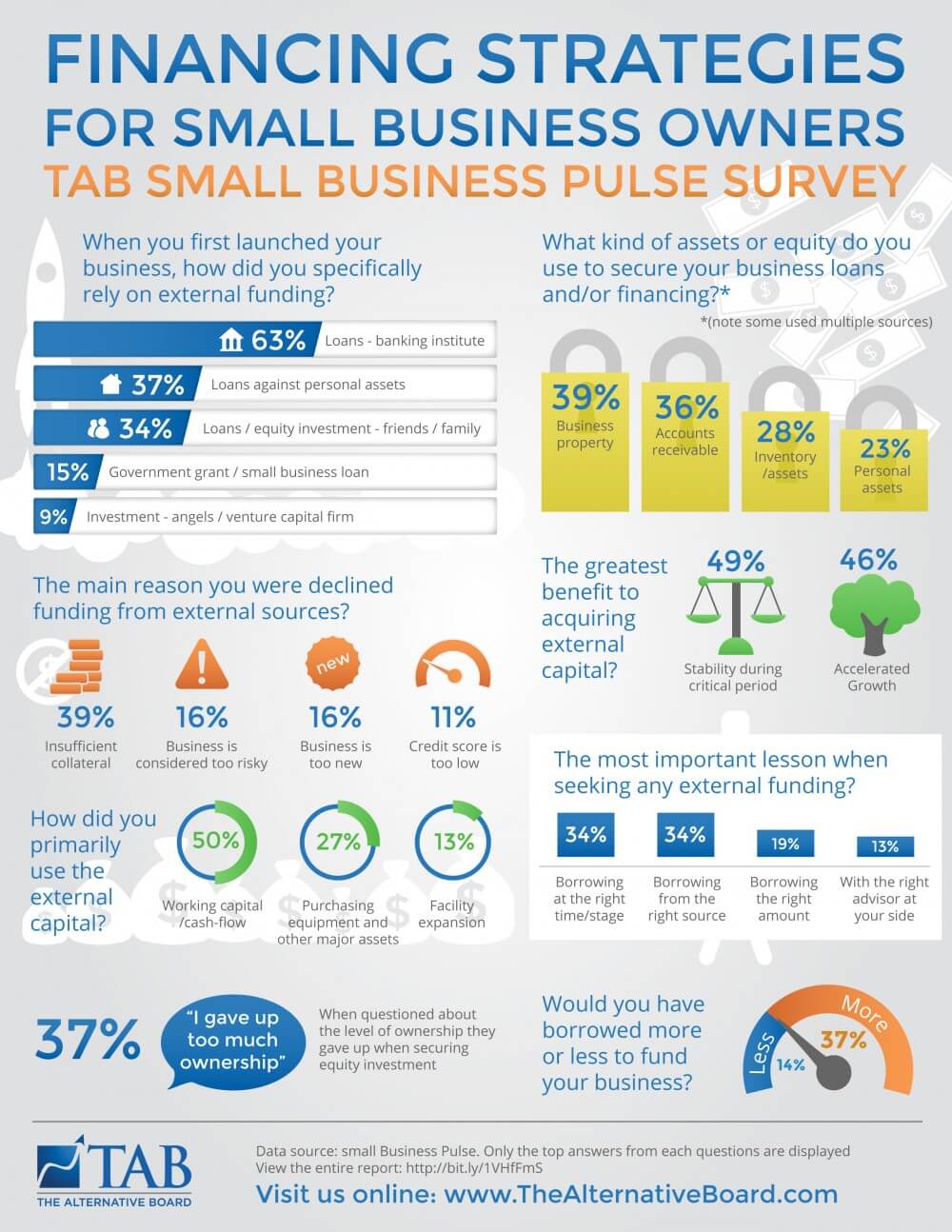

One of the most significant ways the Economic Relief 2024 programs are helping small businesses is through immediate financial assistance. Many small business owners have struggled with cash flow shortages, especially as inflation continues to drive up the cost of raw materials, labor, and overheads. In response, governments are offering grants, low-interest loans, and subsidies to support businesses in maintaining operations.

For example, some countries have rolled out direct grants to businesses in industries most affected by recent economic disruptions, such as hospitality, retail, and travel. These grants can cover a range of expenses, from rent to employee wages, helping small businesses stay afloat during difficult times. Additionally, loan programs with favorable terms—such as deferred repayment schedules or lower interest rates—are helping entrepreneurs avoid the risk of insolvency while also providing them with working capital to sustain daily operations.

Tax Relief: Easing the Burden on Small Business Owners

Tax relief has emerged as another key element of Economic Relief 2024. Small businesses often face significant tax liabilities, especially when revenues fluctuate or their profit margins shrink. To alleviate this burden, many governments are offering temporary tax cuts, tax deferrals, and credits.

In several regions, small business owners have been allowed to defer tax payments, giving them the flexibility to conserve cash flow and redirect funds toward crucial business needs. Some tax credits are specifically designed to reward businesses that maintain or expand their workforce, making it easier for small business owners to hire or retain employees during challenging times. These measures not only reduce the financial pressure on small businesses but also allow them to focus on long-term growth rather than immediate survival.

Promoting Innovation Through Digital Transformation

In 2024, the shift toward digitalization is accelerating, and small businesses that embrace new technologies are better positioned to succeed. Recognizing this, Economic Relief 2024 programs are providing financial support to help small businesses adapt to the digital age. Whether it’s building an e-commerce platform, adopting cloud-based software, or automating operations, digital transformation grants are encouraging small business owners to innovate and streamline their operations.

By investing in technology, small businesses can enhance efficiency, reduce costs, and open up new revenue streams. The government’s role here is crucial in easing the upfront costs of these technological investments. In many cases, grants or tax incentives are available to cover the costs of adopting new software or training employees to use digital tools. This support ensures that even small businesses with limited resources can remain competitive in an increasingly tech-driven world. (Read More: Business Administration Degree: The Foundation for Future Business Leaders in 2024)

Support for Workforce Retention and Development

The Economic Relief 2024 programs have placed a significant emphasis on helping small businesses retain and develop their workforce. During times of economic uncertainty, businesses often face the difficult decision of letting go of employees to cut costs. However, governments have introduced several programs that incentivize businesses to keep their workers, offering support for wages and training.

For example, some governments have introduced wage subsidies, where they contribute a percentage of employee salaries, allowing small businesses to maintain a full workforce even if their revenues are down. Additionally, funds are being allocated to support skill development, enabling small business employees to enhance their capabilities in areas like customer service, digital marketing, and technical skills.

By supporting workforce retention and skill development, these programs help small businesses build a more skilled and stable workforce, ultimately contributing to long-term business growth and stability.

Enhancing Access to Markets: Expanding Opportunities for Small Businesses

Accessing new markets—whether through exports or reaching untapped domestic audiences—is a critical challenge for many small businesses. The Economic Relief 2024 programs are addressing this by offering support to help small businesses expand their reach.

In some regions, the government is facilitating market access by providing financial aid to cover the costs of international trade shows or by supporting digital marketing campaigns that promote small businesses to a global audience. Additionally, small businesses are being supported in navigating regulatory barriers to expand into new markets, both locally and abroad.

These programs aim to help small businesses not only survive but also grow by diversifying their customer base and exploring new revenue streams. By helping them overcome market entry barriers, the government is enabling small businesses to thrive in an increasingly competitive global economy. (Read More: Entrepreneurship as the Engine of Economic Pulse on 2024: Driving Innovation and Growth)

Facilitating Access to Business Networks and Mentorship

One of the lesser-discussed but highly valuable aspects of Economic Relief 2024 is the focus on building networks and mentorship opportunities for small businesses. Governments are recognizing that success isn’t just about financial support; it’s also about knowledge sharing, partnerships, and building connections with other businesses.

Through various relief initiatives, small business owners are being connected with mentors, industry experts, and peer networks. These connections can provide invaluable advice on how to navigate challenges, optimize operations, and scale their businesses. In many cases, the government is funding programs that pair small businesses with experienced advisors who can help them refine their business models, improve their marketing strategies, and better understand their industry’s future trends. (Read More: How Digital Transformation is Shaping Business Administration in 2024)

Long-Term Sustainability: Strengthening Small Businesses for the Future

While Economic Relief 2024 programs are designed to provide immediate support, they are also focused on ensuring the long-term sustainability of small businesses. Through various initiatives, the government is encouraging businesses to adopt environmentally sustainable practices, diversify their supply chains, and adopt more resilient business models.

This focus on long-term sustainability is helping small businesses not only recover from current hardships but also build resilience against future challenges. By encouraging businesses to invest in sustainability, both in terms of operations and workforce development, Economic Relief 2024 programs are ensuring that small businesses are better prepared for the future.

Conclusion article How Economic Relief 2024 Programs Are Impacting Small Businesses

In 2024, Economic Relief 2024 programs are having a profound impact on small businesses worldwide. By offering immediate financial assistance, tax relief, and support for digital transformation, governments are helping small businesses navigate challenging times. Moreover, by focusing on workforce retention, market access, and long-term sustainability, these programs are fostering the growth and resilience of small businesses. As a result, small businesses are better positioned to not only survive but thrive in an ever-changing economic landscape.

[…] Economic Relief 2024 measures are designed not only to provide immediate support but also to lay the groundwork for […]